Create the new software and ensure it’s up-to-date on the newest variation to find the best features and security measures. The days out of race so you can a lender throughout the regular business hours and wishing lined up in order to put a check is more than. Having cellular look at put, you could deposit a check into your account nearly whenever, anywhere, playing with merely their mobile phone or pill. Simply breeze a photograph of your own look at and you can let your account supplier take it from there.

If you make problems whenever endorsing a check otherwise taking pictures of your own view, it can cause your financial business to refuse your own take a look at. You may have to hold off to work out any issues or sense a put off in enabling your financing. Once you’ve finished making their deposit, retain their look at until the complete matter features eliminated your bank account. The financial get advise that you retain your own seek out a particular several months, for example five to help you 1 week.

Down load Our Application to suit your Mobile device

As the software is hung, you’ll need create cellular financial, if you haven’t currently. Your own financial usually enable you to create an excellent login name and you will safe password when you are on their set of entered affiliate out of their product and functions. After this techniques you are securely logged in to the lender account. There are a great number of good stuff regarding the cellular look at deposits, however should also be aware of certain problems that you will happen. Here are the pros and cons from deposit the consider playing with the cellular phone. Deposit restrictions vary from buyers in order to customer and you can away from account so you can account.

Delight opinion its terminology, privacy and defense regulations observe how they apply at you. Pursue isn’t guilty of (and you will cannot render) one things, services or posts at this 3rd-group web site or software, with the exception of services and products one to explicitly bring the newest Chase name. Go shopping with your debit card, and bank of nearly anyplace because of the mobile phone, tablet or computers and most 15,000 ATMs and you will 5,000 twigs. Particular customers having reviewed team account could be billed a purchase fee or another commission to possess mobile deposits. Wells Fargo On the internet and Wells Fargo Online businesses® users who take care of a qualified checking or savings account qualify to make use of mobile deposit.

Examining & Discounts. Along with her.

Next put the look at so it wjpartners.com.au significant hyperlink lies apartment to the a dark colored-coloured, sufficiently lighted skin. With ease screen your own profile with membership and you will shelter alerts14 delivered via email otherwise text. Get quick access in order to many PNC Savings account associated advice best over the telephone. Factual statements about Pursue Total Examining® might have been collected on their own because of the CNBC Discover and has maybe not already been analyzed otherwise provided with the newest issuer of the card prior to publication. The capital One to® app provides a wide range of beneficial features that make it a high options.

You will view it on your own set of latest transactions in one working day. Include bucks to the qualified examining or family savings at any CVS®, Walgreens® otherwise Duane Reade by the Walgreens® place in the You.S. Along with, just remember that , agents may possibly costs their own fees for making use of which commission method to make places or withdrawals.

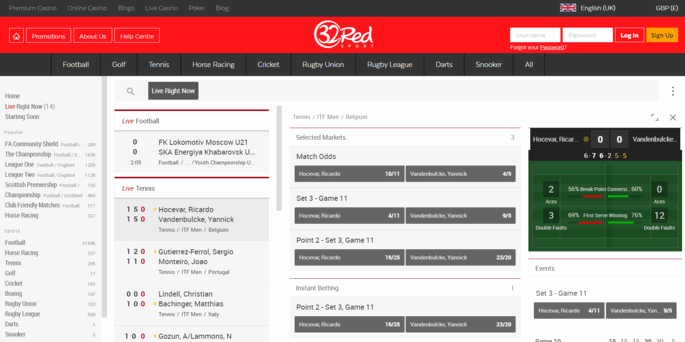

While most banking institutions today features cellular features, these represent the greatest mobile banking software for 2022. You could potentially constantly find your own lender’s mobile put restriction from the signing to your on line banking account otherwise getting in touch with their financial’s customer support department. The newest cellular deposit restrict is generally listed in the newest conditions and you may standards of your account. After you’lso are happy to put your look at, open the cellular banking software and stick to the tips making a mobile take a look at deposit. Wells Fargo imposes every day and month-to-month limits on the complete dollars amount of view places you could make thru cellular deposit.

This task becomes necessary because of the financial legislation and assists make sure that your look at are canned properly and you can straight away. Keep in mind that dependent on your own cellular phone bundle, content and you can analysis charges can get pertain. Concurrently, cellular provider access near you may also limitation cellular deposit availability. Several prepaid credit card issuers offer cellular deposits, that allow one to fool around with an android otherwise apple’s ios application to put a check for the prepaid card. You’ll capture photos of your take a look at inside the software and get into consider advice, such as the amount, to accomplish their deposit.

Think of for additional defense, constantly sign off completely once you find yourself with the Wells Fargo Cellular app by searching for Sign-off. You can see the new position of one’s put in the Account Hobby to the suitable account. If your images isn’t really some really good, the new software won’t be sure whether the take a look at is actually legitimate and also the consider can’t be affirmed. If the look at will be recorded, the new application will always render recommendations to own raising the photos high quality and enable several retakes. Loan providers benefit through a lot fewer trips in order to ATMs to select right up bodily monitors and you may attracting customers which may be outside its immediate geographical area.

You may find More info From the Our Business For the FINRA’S BROKERCHECK. All bucks and you will securities kept in the Axos Dedicate buyer profile try protected by SIPC up to $five-hundred,100, that have a limit of $250,one hundred thousand for cash. Always remark your own lender’s mobile put assistance to help prevent processing waits or denied dumps. All the prepaid credit card cellular put apps that people researched arrive to your one another Ios and android networks.

If there’s a hang on your account for any reason, you may not be able to put a check utilizing the mobile application. Try to get hold of your financial to respond to the newest hold prior to a deposit. If the account is suspended, you would not manage to put a with the cellular app.

The applying rounds right up debit cards requests and you will immediately dumps the new a lot more turn into a bank account, which is tracked in the cellular app. With Bell Cellular Consider Deposit, you could deposit monitors digitally utilizing the Bell Financial mobile software, removing the necessity to generate a physical lender put. Still, you should consult with your financial company to your the new facts away from mobile money acquisition deposits. If you’re not associated with the financial institutions detailed, it is important to consult financial institutions themselves. If the such agencies features trained united states one thing, it’s your process differs by area and business.